Step 1: Attend a Homebuyer Education Course

Attend a pre-purchase Homebuyer Education Course through one of the DHAP and HUD Approved Education Providers. This course will prepare you for the home purchasing process. Once the course is completed the education provider will give you a certificate of completion that is valid for 1-year.

Step 2: Contact an Approved Lender

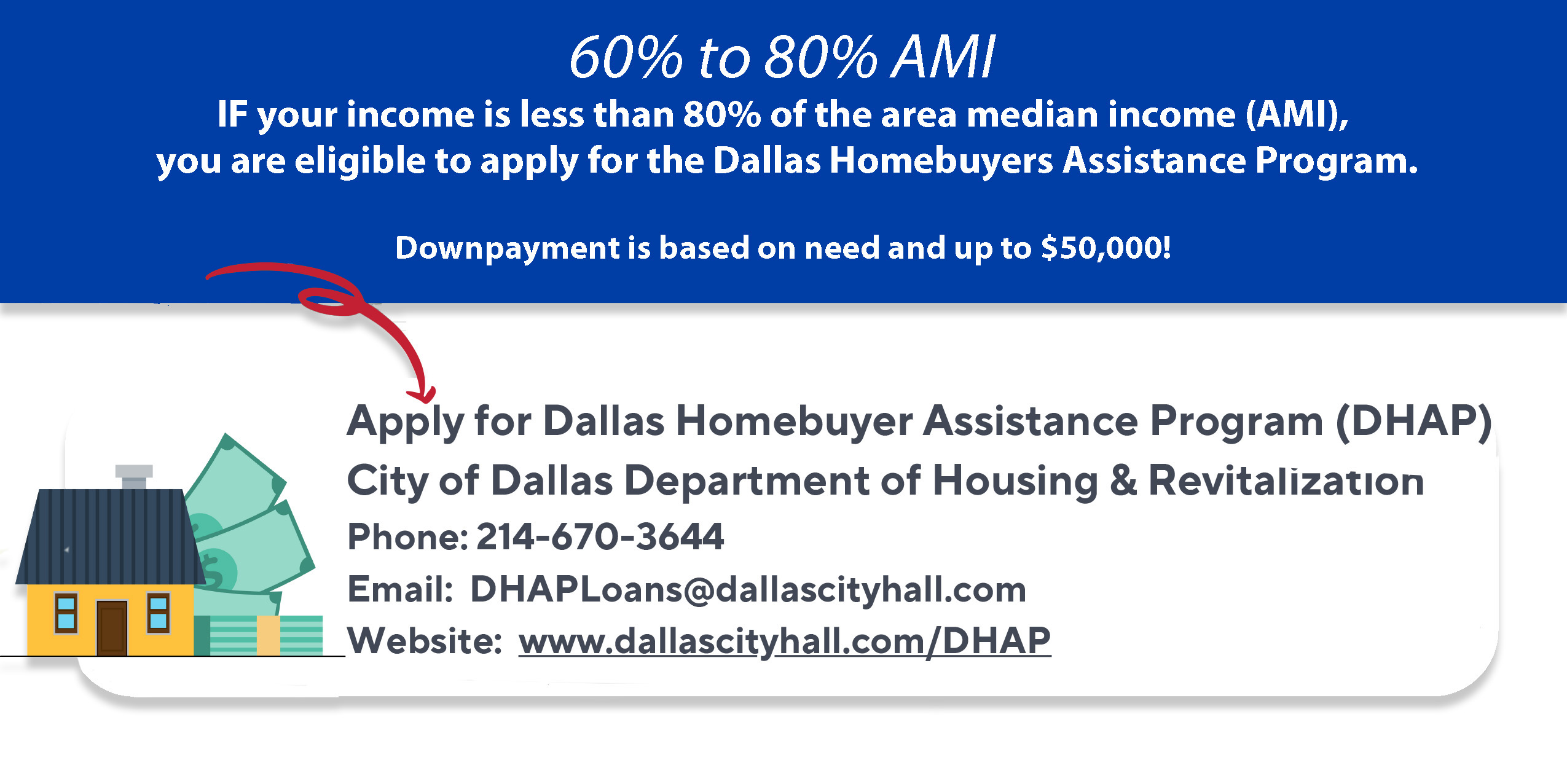

Contact a DHAP approved lender on the program website under Approved Lenders. Inform them you want to apply for the Dallas Homebuyer Assistance Program for down payment and closing cost funds. The lender will review all your information and provide you with a pre-qualification letter that will reflect a sales price they will finance.

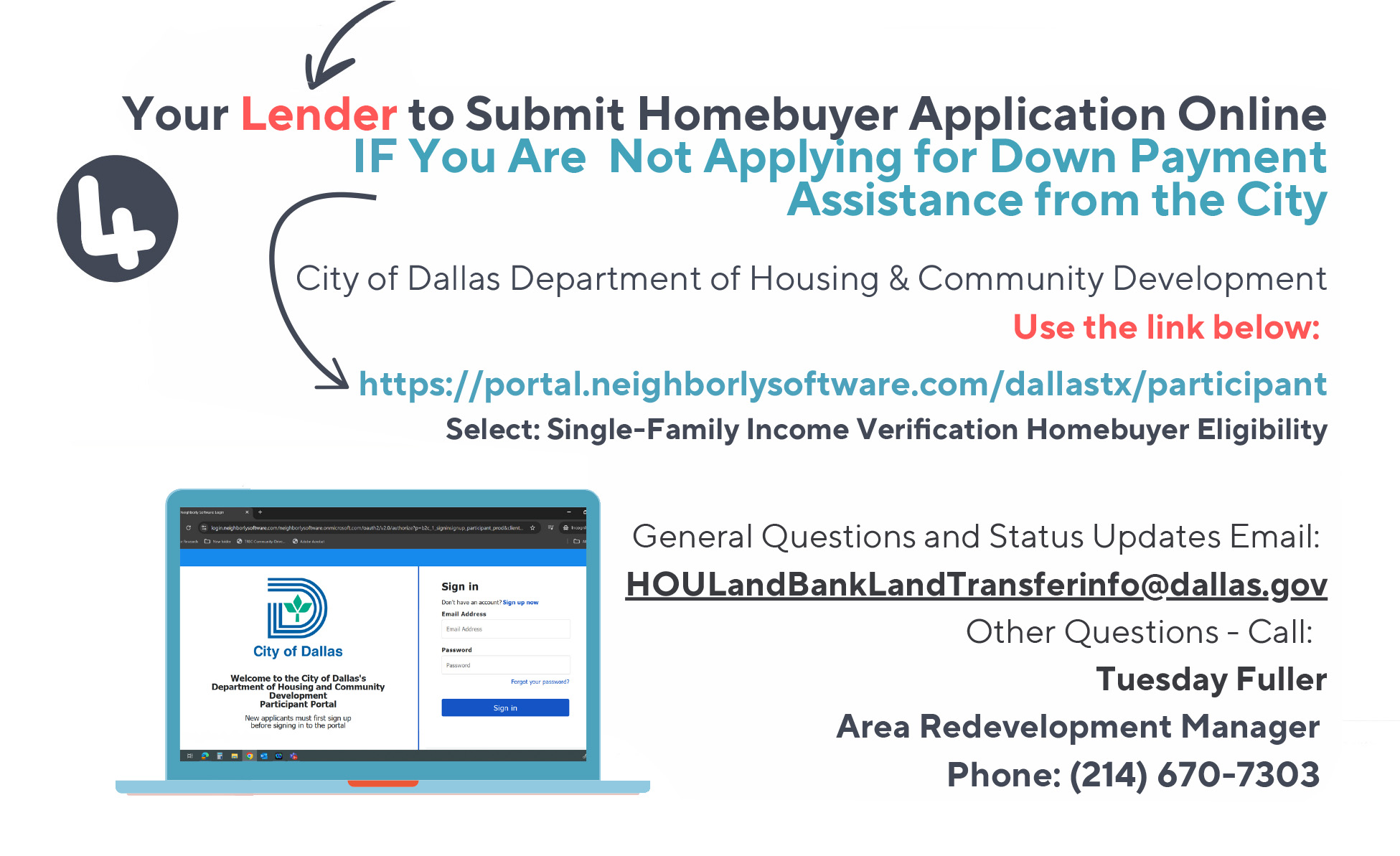

Step 3: Submit an Application

Submit an online application for DHAP at Neighborly Software Portal. Select the portal for Dallas Homebuyer Assistance Program. DHAP will review your household information to determine if you meet the eligibility requirements of the program and will provide you with a conditional letter of eligibility to provide to your lender. All applicable documents must be uploaded into the Neighborly Software System via .pdf. .jpg or.doc format. Use the DHAP Checklist to ensure all documents have been uploaded.

Step 4: Contact a Real Estate Agent

Once you have received the prequalification from a lender and a conditional letter of eligibility from DHAP, your next step should be to contact a real estate buyer’s agent to be your representative in the home purchasing process and supply the prequalification letter to the agent. Once you have selected your realtor, they will work with Trinity Community Holdings listing agent to prepare a purchase/sales contract.

Step 5: Final Review Process

When you have an executed purchase/sales contract for a home, and funds are still available, the lender will work directly with the City of Dallas to process your loan application and determine the amount of assistance you may receive. Upon the initial underwrite of the loan application, all files are subject to a final review process before closings can be set. Homebuyers, mortgage lenders, and realtors should anticipate up to 45 days for the final review process.

QUESTIONS

Al Herron

Realtor, Listing Agent

Monument Realty

Phone: (469) 516-2415

Email: al@monumentstar.com

Nicole Raphiel

Community Development Project Manager

St. Philip’s School and Community Center

Phone: (214) 421-5221

Email: NRaphiel@stphilips.com

Homebuyer’s Education Guidance

Roxana Smith

Sr. Housing Administrator

Services of Hope

Phone: (214) 210-8569

Email: roxana@servicesofhope.org